Insurance

PRO’s leadership team is comprised of industry experts in the Insurance space. Our team is in sync with market factors impacting the industry. With the rise in technical enhancements over the last 20 years, it’s more critical than ever for companies to have a complete outlook on their processes to ensure technical solutions are applied correctly, antiquated processes are pruned, and processes are redesigned to fit the modern era.

With the rise in inflation driving consumer costs and limiting Underwriter profitability, Insurance firms need to run like well-oiled machines to compete for market share. PRO’s philosophy relies on simple, yet effective, solutions delivering both near term results and long-term strategic benefit.

Functional Areas

-

New Business

-

Onboarding

-

Claims Adjudication

-

Claims Appeals

-

Billing

-

Human Resources

-

Policyholder Services

-

Marketing

-

Auto Total Loss

-

Agent Services

- New Business

- Onboarding

- Claims Adjudication

- Claims Appeals

- Billing

- Human Resources

- Policyholder Services

- Marketing

- Auto Total Loss

- Agent Services

“PRO set the standard for the vendors we partner with”

CEO, Top Insurance Agency

A Project with PRO…

Could Generate Similar Benefits

By Identifying and Addressing Key Operational Issues

Technology Productivity (36)

Inefficient Processes (24)

Business Measures & Management Control (20)

Capacity Modeling & Resource Planning (15)

Systems Limitations (15)

Claims Case Study

A leading National Supplemental Insurer was experiencing substantial service shortfalls and cost challenges within the Claims Production organization. Pending claims volume across 5 primary product lines consistently exceeded service parameters and attracted regulatory scrutiny.

Over an eighteen-week period, PRO developed and implemented capacity models and management routines allowing the organization to recognize significant resource economies and improve operational control through actionable reporting.

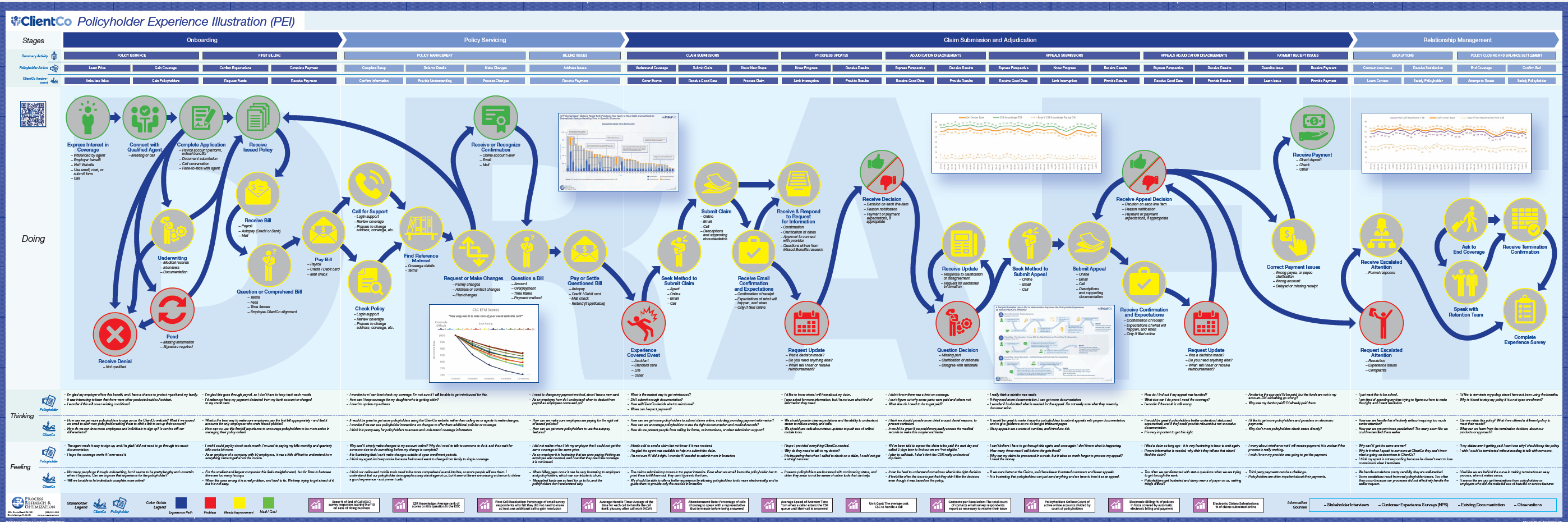

Policyholder Journey

End-to-End Policyholder Life Cycle flow. This Journey map outlines key challenges from the perspective of the policyholder. The flow is outlined in 4 key segments:

- Onboarding

- Policy Servicing

- Claims Submission and Adjudication

- Relationship Management

- Onboarding

- Policy Servicing

- Claims Submission and Adjudication

- Relationship Management