Banking

PRO’s Financial Services Team has a depth of industry experience in all areas of commercial, corporate, retail and mortgage banking. In an increasingly competitive environment with building pressure from rising inflation and unstable interest rates, our teams optimize processes – operationalizing regulatory controls, driving sales lift, and improving product margins.

The existing economic realities coupled with continued pressure from non-traditional providers requires that all our projects focus on delivering top line revenue growth coupled with a laser focus on efficiency ratios. PRO’s comprehensive firsthand banking and project experience enables us to accelerate both new and existing initiatives. Our templated, research-based approach drives immediate opportunities with an eye on longer-term market, functional, and technology challenges.

Functional Areas

-

Commercial Cash Management

-

Retail Deposit Products

-

Credit Administration

-

Retail and Mortgage Lending

-

Real Estate Asset Management

-

Loan Servicing

-

Credit Card and Payment Services

-

Contact Center Operations

-

Finance and Accounting

-

Human Resources

-

Vendor Management

-

Commercial Lending

- Commercial Cash Management

- Retail Deposit Products

- Credit Administration

- Retail and Mortgage Lending

- Real Estate Asset Management

- Loan Servicing

- Credit Card and Payment Services

- Contact Center Operations

- Finance and Accounting

- Human Resources

- Vendor Management

- Commercial Lending

“PRO’s ability to deconstruct our process and redesign customer centric processes has allowed us to drive greater value to our client base while generating meaningful and sustained cost reduction”

VP of Commercial Lending, Major US Banking Company

A Project with PRO…

Could Generate Similar Benefits

By Identifying and Addressing Key Operational Issues

Poor Account Opening Experience (36)

Complex Service Offerings (24)

Limited Products & Services (20)

Extended Credit Approvals (15)

Inexperienced Advisors (15)

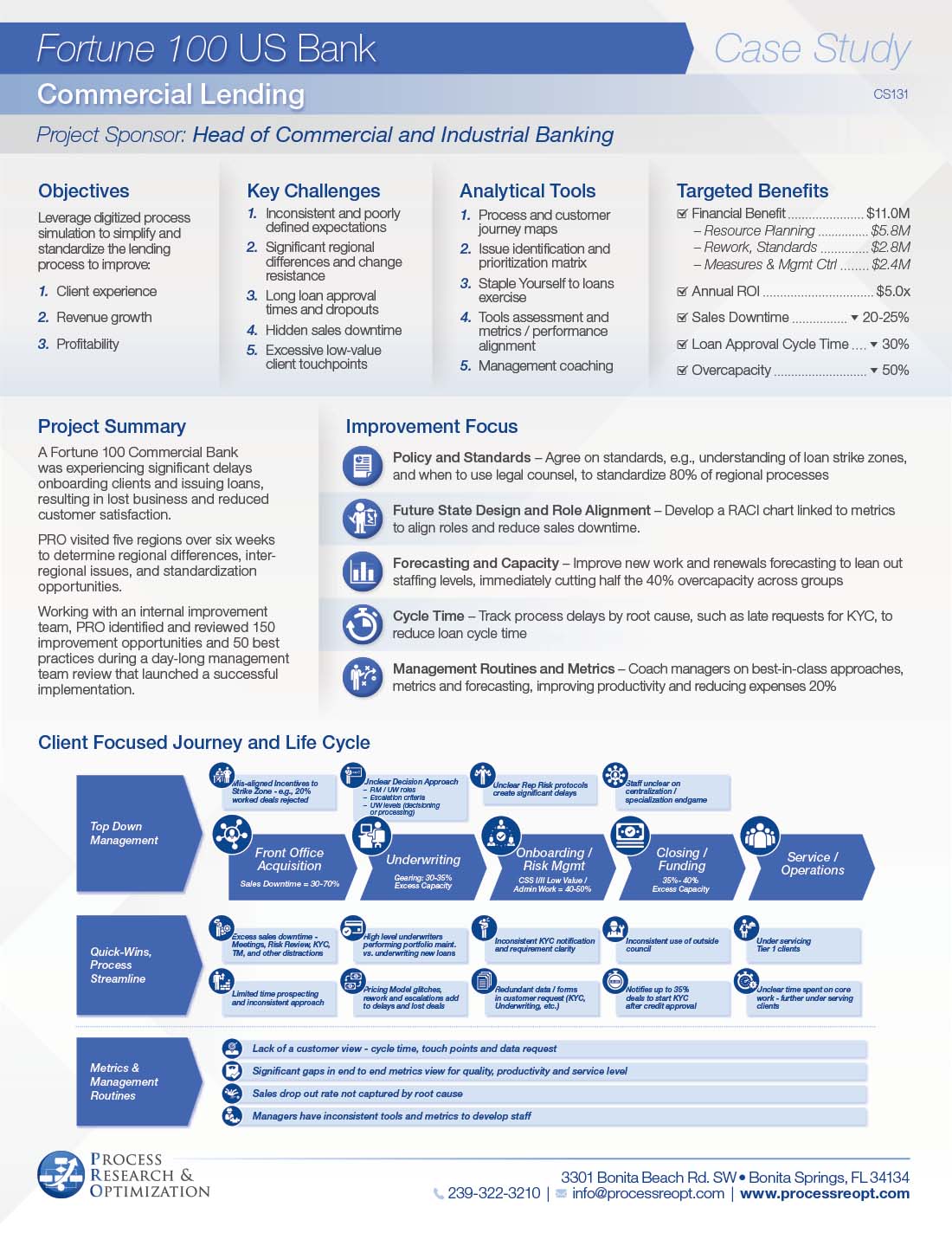

Commercial Lending Case Study

A Fortune 100 Commercial Bank was experiencing significant delays onboarding clients and issuing loans, resulting in lost business and reduced customer satisfaction.

Working with an internal improvement team, PRO identified and reviewed 150 improvement opportunities and 50 best practices during a day-long management team review that launched a successful implementation.

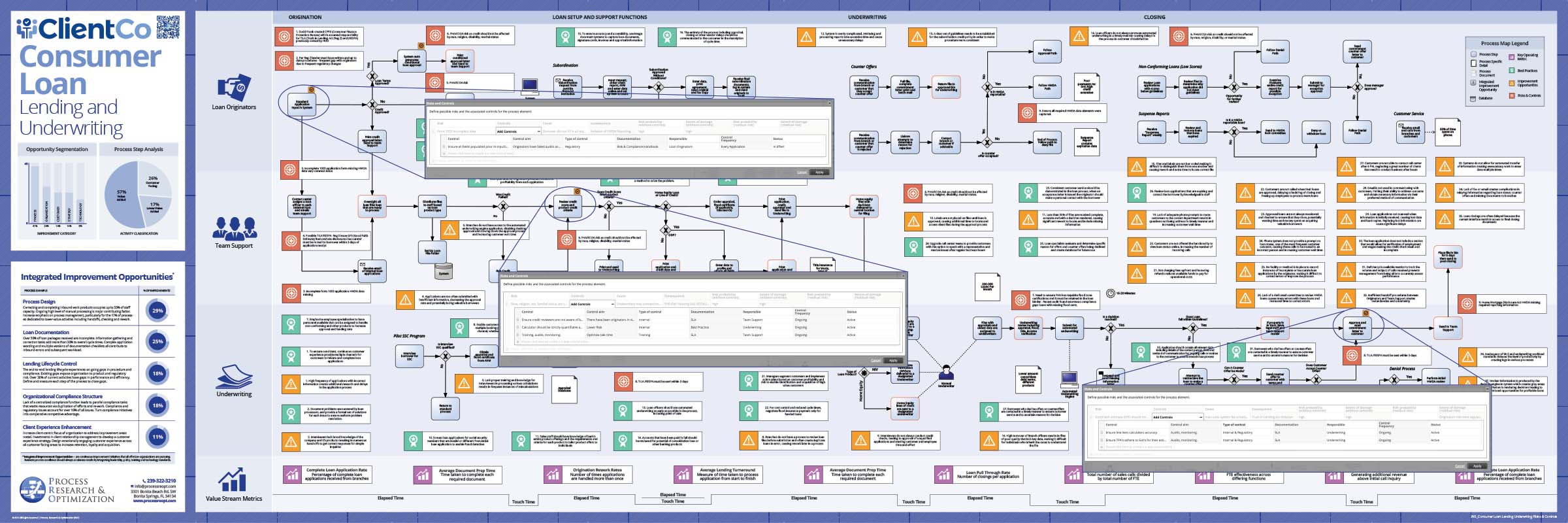

Consumer Lending and Underwriting Process

Our clients are always seeking operational excellence and process discipline. Our Consumer Loan Process map outlines the current state process, along with Key Operational Improvements and Best Practices. At a high level, the map outlines four key phases in the process, those being:

- Origination

- Loan Setup and Support Functions

- Underwriting

- Closing

- Origination

- Loan Setup and Support Functions

- Underwriting

- Closing